In the quiet villages of Rajukhedi and Semli Khurd, nestled within a Panchayat of just over 540 households, the idea of paying taxes felt distant—irrelevant even. For years, self-revenue generation through local tax collection was dismally low, hovering at less than 2%. Only 10 households, out of the many eligible, regularly contributed property or business taxes. As a result, the Panchayat remained almost entirely dependent on external grants and schemes, struggling to meet even the most basic development needs—be it water conservation, sanitation infrastructure, or maintenance of public spaces.

The disconnect was palpable. When I began working closely with the community, it became clear that this wasn't merely a logistical problem—it was a problem of perception. Villagers didn’t see the value in paying taxes because they hadn’t seen tangible benefits in return. There was limited awareness, a deep trust deficit between the Panchayat and its people, and a political hesitancy rooted in the fear of upsetting voters. For many leaders, asking constituents for taxes felt like a threat to their legitimacy, especially in a setting where local relationships and loyalties hold great weight.

But what if tax collection could be reimagined not as a demand, but as an invitation—to co-own the development of one’s village?

With this belief, I initiated a pilot project across Rajukhedi and Semli Khurd, grounded in two principles: capacity-building of local institutions and community awareness rooted in trust. We began by training members of the Panchayati Raj Institutions (PRIs)—Sarpanch, Sachiv, GRS, and Lekhpal—on the nuts and bolts of local taxation: rules, exemptions, the benefits of self-revenue, and above all, the importance of transparency. These sessions were more than technical briefings—they were confidence-building efforts to shift the narrative from “asking for money” to “enabling ownership.”

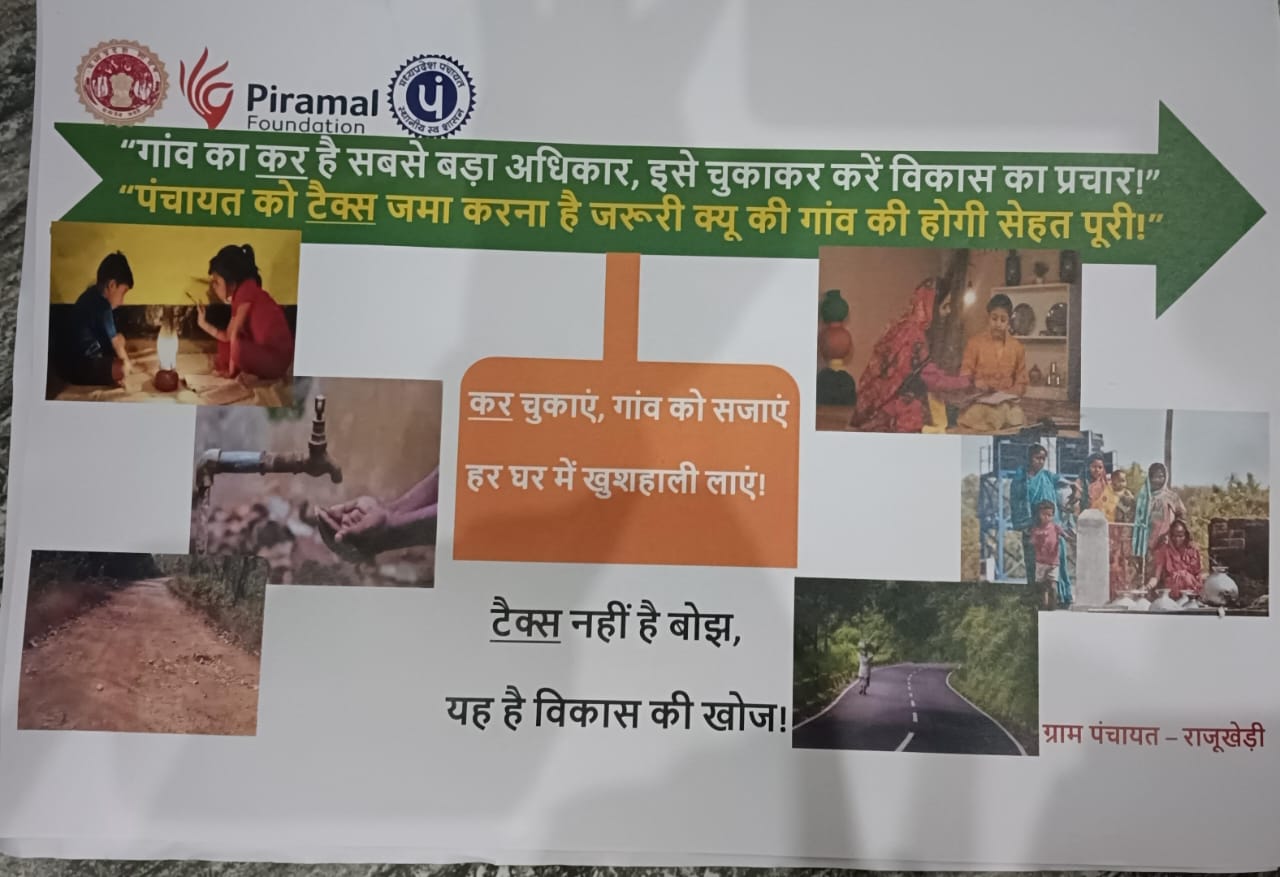

In parallel, we launched a vibrant, locally-rooted awareness campaign. Children from local schools painted walls with messages on civic responsibility. Households received hand-delivered pamphlets and had one-on-one conversations about how tax contributions—however small—could unlock long-term benefits for their own families. This wasn’t about enforcement; it was about education and equity. Crucially, we agreed that Below Poverty Line (BPL) families would be excluded, to ensure the process remained fair and non-exploitative.

Change, however, rarely comes easily. Initial meetings were tense. The Sarpanch was apprehensive—understandably so. But repeated dialogue helped shift the mindset. Once convinced that only capable households and local businesses were being targeted, and that the process would be transparent and accountable, the PRI team came on board. Together, we co-designed the tax collection process—from identifying eligible households and small enterprises, to issuing 100 newly designed tax notices, to setting up QR-code-enabled payment systems that linked directly to the Panchayat’s bank account.

What followed was nothing short of transformative.

In the first phase itself, 60 new taxpayers registered—a sixfold increase. A total of ₹62,000 was collected, all through voluntary, informed contributions. These funds were immediately reinvested into visible community priorities: improving sanitation and conserving water, creating a feedback loop where people could see their tax rupees at work. The PRI members, once hesitant, now led the effort with confidence and clarity—ready to take the initiative forward independently.

Beyond the numbers, what changed was the culture. People began to speak of taxes not with suspicion, but with pride. The Panchayat’s shift from dependence to aspiration for self-reliance had begun. And perhaps most telling of all, other nearby villages began expressing interest in adopting similar models.

This pilot has laid the foundation for something deeper—a culture of accountability, where development is not the sole responsibility of the state, but a shared journey between citizens and institutions. As we look ahead, the vision is to scale local tax coverage from under 2% to beyond 20%, building a Panchayat that doesn't just wait for funding, but drives its own progress.

TAGS

SHARE